PCORI Fees

If you have an HRA plan and are required to pay PCORI fees no later than July 31, 2022

(For an explanation on PCORI fees and your responsibility please see below)

If your HRA is integrated with a self-funded major medical plan, then you do not have to pay the PCORI fee for the HRA.

Good news! This year you can run your own PCORI report to obtain the average number of reportable lives for your HRA benefit(s). Once you have run the PCORI report from the WealthCare system you will use the average number of lives from this excel report to complete IRS Form 720 https://www.irs.gov/pub/irs-pdf/f720.pdf (Part II IRS No. 133).

In addition to completing Form 720, you must make your payment to the IRS per the payment voucher at the end of Form 720 and closely follow the directions under the section marked Form 720-V Payment Voucher—this will provide you with details on who to make the check payable to.

Below you will find directions on how to run the PCORI report once logged into the WealthCare System

Things to keep in mind as you run the PCORI report:

- When running the report, you will need to select “Account Type” you should select form the following account types (HRA, HR2 HR3, HR4, HRX). In most cases your plan will be labelled HRA but there are HRA plans that have to use some of the listed alternative labels

- If you have multiple HRAs with different employees associated with each HRA benefit

(Each HRA being linked to a specific group health plan) then you will need to:

Run a report for each one of these HRAs and

Sum the average number from each report to get your total reportable lives number.

- If ABG did not administer your HRA for the plan year that ended in 2019 we cannot help you with your PCORI fee calculation.

Directions for Running the PCORI Report from the WealthCare System

In the ABG WealthCare Administration System

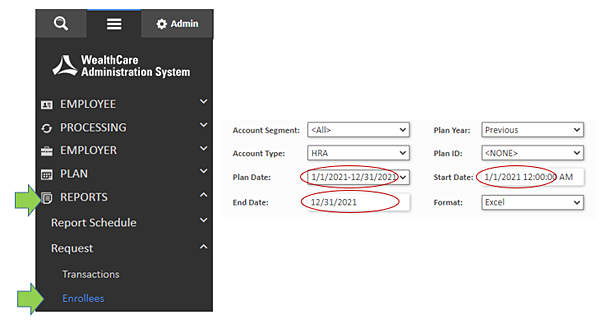

- Click on the hamburger menu (3 horizontal lines)

- Click Reports

- Click Request

- Click Enrollees

- In the list of report, click the hyperlink for the PCORI Report

- You will need to change the dropdown for the “Plan Year” to Previous

- Select Account Type HRA (or HR2, HR3, HRX if applicable)

- From the “Plan Date” drop down menu select the Plan Date that ends in 2021

- Change the Start Date and End Date to the first day of the plan year start and the last day of the plan year, for the selected Plan Date

- Run in FORMAT:Excel (not CSV)

- Click Generate

- Go back to the hamburger menu/Reports/Result and click View reports

- Once you have the report open, you can determine the average lives under column F by

- Enabling Editing on the file, sum the Active Lives (Column F) and using the Average that shows in the bottom right of your spreadsheet. The number showing as the “average” are your reportable Average lives. Multiply this number by the fee per life $2.66 for HRAs that end in January through September of 2021 and $2.79 per life for plans whose plan years end October through December 2021. This total will be the amount due for your PCORI fees.

Once you have run the report for your HRA plan year ending in 2021 please use the Average number you see in the bottom of the excel report. Please report this number under “(a) Avg. number of lives covered” on IRS form 720 (Part II IRS No. 133).

- If your HRA plan year ended in January of 2021 through September of 2021,

you will be responsible to pay $2.66 for each life reported - If your HRA Plan year ended in October, November or December of 2021,

you will be responsible to pay $2.79 for each life reported

|

Your HRA Plan Year |

Rate you pay for Average Life Covered |

|

February 2020 - January 2021 |

$2.66 |

|

March 2020 - February 2021 |

$2.66 |

|

April 2020 - March 2021 |

$2.66 |

|

May 2020 - April 2021 |

$2.66 |

|

June 2020 - May 2021 |

$2.66 |

|

July 2020 - June 2021 |

$2.66 |

|

August 2020 - July 2021 |

$2.66 |

|

September 2020 - August 2021 |

$2.66 |

|

October 2020 - September 2021 |

$2.66 |

|

November 2020 - October 2021 |

$2.79 |

|

December 2020 - November 2021 |

$2.79 |

|

January 2021 - December 2021 |

$2.79 |

As part of the Patient Protection and Affordable Care Act (PPACA) your Patient Centered Outcomes Research Institute (PCORI) fee for your HRA plan(s) (which falls within the definition of an applicable self-insured health plan) is due on July 31, 2022. The July 2022 fee for your HRA is based on all HRA plan years ending in 2021.

Employers are responsible to pay the PCORI fee by filing IRS Form 720 (click on the hyperlink to download the form), Part II IRS No.133 (please click on accompanying instructions for additional details from the IRS website—scroll down to Part II). Although the Form 720 is designed for quarterly payment of certain excise taxes, the PCORI fee is only paid annually.

Because your HRA is linked to/integrated with your group health plan, and, assuming that your group health plan is a fully insured health plan, you will be using the Actual Count Method for calculating the average number of covered lives. The PCORI fee that is due on July 31 the fee is calculated by taking the average number of lives covered under your HRA and multiplying this figure by the rate of $2.66 for plan years that end between January and September of 2021 and $2.79 for plan year that end between October through December of 2021.

Please note that HRAs that are integrated with a fully insured group health plan are treated as single coverage when calculating the average lives, even though the funds may be used to cover spouses’ and dependents’ medical expenses. If your HRA is integrated with/linked to a self-insured group health plan, then your self-insured group health plan and the linked HRA may be treated as a single plan for purposes of calculating the PCORI fee.

PCORI Fee Is Deductible

The IRS stated in a May 31, 2013, memorandum that the PCORI fee is an “ordinary and necessary business expense paid or incurred in carrying on a trade or business” and as result is tax-deductible.